28 May 2025

How to structure your Supply Chains in India?

India is changing rapidly. It is extremely important for companies to take note of the changing landscape and adapt their Distribution Strategies to ensure their continued success in this key market.

Notable Recent Developments

- Becoming one of the largest domestic markets

The world’s most populous economy is expected to have a consumption of $10.7 trillion and become the 3rd largest consumer market by 2030 - Rising disposable incomes across the country

There is an increase in the population of super rich in Tier-1 metro cities and of young, aspirational and increasingly affluent population in Tier-2 and 3 cities - Exponential growth of e-commerce

E-commerce in India is growing with a CAGR of 27%, D2C with a CAGR of 38% and Quick commerce with a CAGR of 28% - Development of physical infrastructure

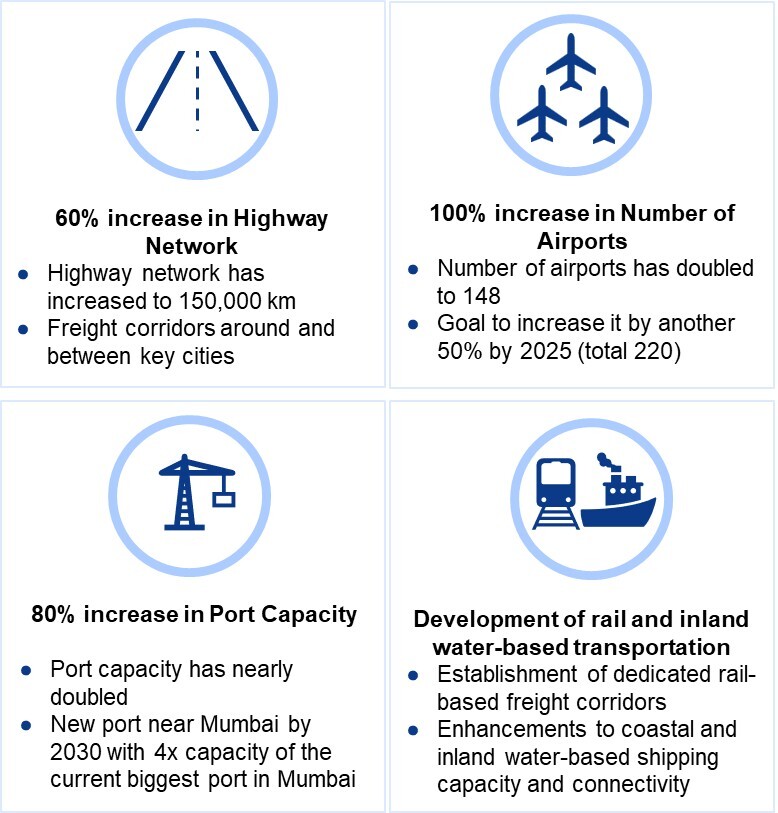

Over the last decade, there has been a 100% increase in number of airports, 80% increase in seaport capacity and 60% increase in length of highway network in India. Improved physical infrastructure is a key enabler for businesses to realize their business and distribution strategies in India. - Nation-wide unified tax regime

With the implementation of Goods & Services Tax in 2017, India transitioned India away from multiple taxes levied separately by each state to a single national-level Goods & Services Tax. This continues to yield benefits for businesses and have ripple effects on the distribution networks in India.

Image 1: Infrastructure Development 2014 – 2024

Advice for Companies setting up a new Distribution Footprint in India

While selecting a DC location requires detailed analysis, a rule of thumb generally followed by companies is choosing either New Delhi or Mumbai as the location based on the value of their products. Companies with high-value products who airfreight their products into the country typically set up their first DCs in Delhi. Companies with relatively lower-value products who bring their products into the country by ocean tend to start with Mumbai as their first DC location. As companies continue to grow, they grow their distribution networks based on volume and service level requirements. For example, with a 4-DC setup companies can service all the main demand centres in India within 2 days.

Advice for Companies with existing Distribution Footprint in India

The old tax regime necessitated a fragmented retail distribution network consisting of small godown-style warehouses in each state that the companies operated in. With nation-wide GST, companies should seize the opportunity to move towards a consolidated, regional distribution network setup within India consisting of large Grade A warehouses and hub-and-spoke model for transportation network with large trucks. These will allow companies to achieve economies of scale and greater efficiencies in operations.

Meeting e-commerce demand

To meet increased service level expectations of customers for online deliveries, companies need to expand their ecommerce distribution network by adding (micro) fulfilment centres and delivery hubs to reduce middle-mile and last-mile delivery distances. Employing innovative fulfilment strategies will be increasingly essential for companies to compete in the market.

India’s potential as a regional hub for South & Southeast Asia

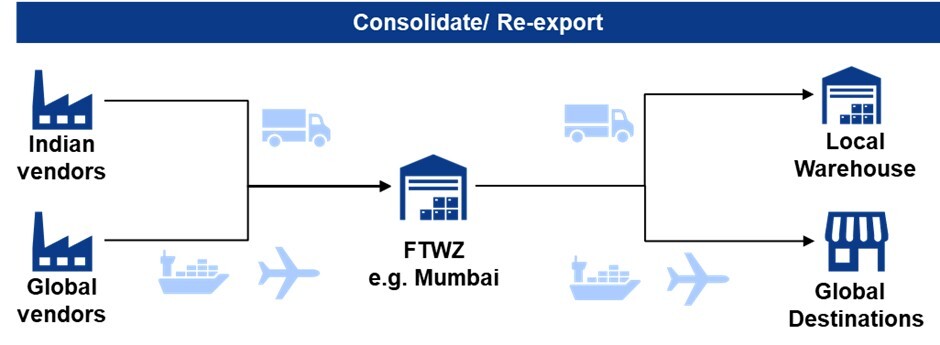

There is an increasing trend of companies setting up their regional or global distribution centres in India due to multiple reasons. First, companies with significant manufacturing output in India take advantage of low storage and labour costs to setup low-cost Consolidation Centres in the country. With increase in India’s manufacturing output, this becomes an attractive option for many companies. On top of the manufacturing output, companies with strong sales in APAC and having National Distribution Centres for major markets like Japan, Korea, Australia and China can potentially leverage India as an RDC for smaller markets of South and Southeast Asia .

Image 2: Consolidation Centre in a Free Trade Warehousing Zone in India

Proven Case Study

BCI recently did a network design study for an industrial manufacturing client in India that wanted to optimize its distribution network and set the foundation for supporting strong growth ahead. BCI managed to achieve this goal while at the same time achieving overall cost reduction and improved service levels. This included warehouse consolidation (going from a network of 1 central warehouse & 8 small warehouses to a network of 1 central distribution centre & 4 regional distribution centres), inventory reduction (going from all SKUs in all warehouses to all SKUs only in the central DC & only fast runners in the 4 DCs) and transport optimization (going from LTL-dominated transportation to FTL-based closed-loop transportation).

Conclusion

To ensure success in India, companies should assess whether their current distribution network is scalable for future growth, whether it allows them to effectively service all the channels, what their network requirements are and what it means for costs and service level.

In conclusion, it is important for companies to keep up with the developments in India by taking a holistic approach towards reviewing their distribution network and operations. This will enable them to reduce risks and identify opportunities for growth.