06 June 2025

Transport Rates Face Shifts Amid Economic and Regulatory Pressures

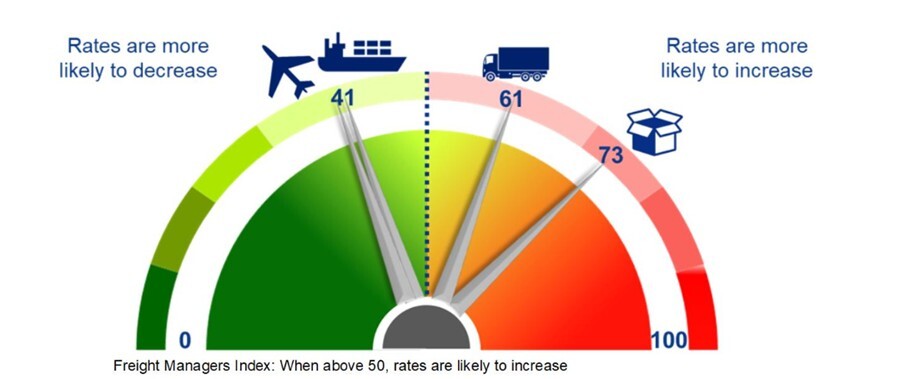

Transport rates across Europe and global freight markets are decreasing (air/ocean) or stable/slight increase (road/parcel) especially for Germany and the UK, according to the 13th BCI Transport Monitor.

Road transport in Europe is expected to soften, with the FMI index dropping to 61 from 91 in October 2024. Despite economic slowdown, a minor increase in rates is projected, driven by new German toll tiers, driver shortages, and expanded road taxes in Austria, the Czech Republic, and Denmark.

Recommendation: tender out in specific markets as this will provide opportunities.

Ocean freight rates are anticipated to decrease, with an FMI of 41. Overcapacity, slower demand, and tariff uncertainty—especially on high-tariff lanes like China–US—are key factors. Market volatility remains very high leading towards potential sudden rate shifts and constraints in terms of available capacity.

Recommendation: Tender ocean freight will provide opportunities

Airfreight holds an FMI of 41, signaling slightly falling rates. Global volumes have dropped by 7%, affected by seasonality and a shift in e-commerce trends due to the removal of the “de minimis” exemption. Rate volatility remains high due to gopolitical tensions

Recommendation: tender air freight and execute before next high season

Parcel transport shows a likely modest increase (FMI 73), with domestic rates up 1.5% and cross-border up 3%, mainly due to inflation and regulatory changes, especially in the UK and Germany.

Recommendation: Tender may give opportunities, however, pick right market and execute before coming high season

Feel free to download the full deck below, helping you take the next step in your transport management journey.

For more information, contact one of our consultants below:

- Henry van den Born, Senior Consultant, at henry.born@bciglobal.com

- Robert Wieggers, Principal Consultant, at robert.wieggers@bciglobal.com

- Carlo Peters, Principal Consultant, at carlo.peters@bciglobal.com

Source: BCI Global 2025

Read more here: 13th BCI Transport Monitor PDF-bestand